Introduction

In today’s digital age, where personal information is increasingly at risk, safeguarding your credit and financial identity has never been more critical. One powerful tool at your disposal is the TransUnion credit freeze. In this comprehensive guide, we will delve into the world of TransUnion credit freezes, exploring what they are, why they matter, how to implement them, and their potential implications.

What Is a TransUnion Credit Freeze?

A TransUnion credit freeze, also known as a security freeze, is a proactive measure that empowers you to take control of your credit report’s accessibility. By initiating a credit freeze with TransUnion, you essentially block potential creditors and lenders from accessing your TransUnion credit report. Without access to this crucial piece of financial information, it becomes challenging for identity thieves and fraudsters to open new credit accounts in your name.

Why Do You Need a TransUnion Credit Freeze?

- Identity Theft Protection: Identity theft is a pervasive problem, and your credit report is a treasure trove of personal and financial data. A TransUnion credit freeze acts as a robust shield against unauthorized access, reducing the risk of fraudulent accounts being opened in your name.

- Enhanced Security: While it’s essential to practice good online security hygiene, a credit freeze provides an additional layer of protection. It ensures that even if your personal information is compromised, potential fraudsters will encounter a significant roadblock when attempting to open new accounts.

- Peace of Mind: Knowing that your credit report is secure can offer peace of mind. You can go about your financial activities without constantly worrying about unauthorized access to your credit history.

How to Implement a TransUnion Credit Freeze

Implementing a TransUnion credit freeze is a straightforward process:

1. Contact TransUnion

Start by reaching out to TransUnion, one of the three major credit bureaus in the United States. You can initiate the credit freeze through their website, by phone, or by mail.

2. Provide Personal Information

To verify your identity, TransUnion will request personal information such as your full name, address, Social Security number, and date of birth. Be prepared to provide this information accurately.

3. Receive a Unique PIN

Once your request is processed, TransUnion will provide you with a unique Personal Identification Number (PIN) or password. This PIN is crucial, as you’ll need it to lift or thaw the freeze temporarily when applying for new credit.

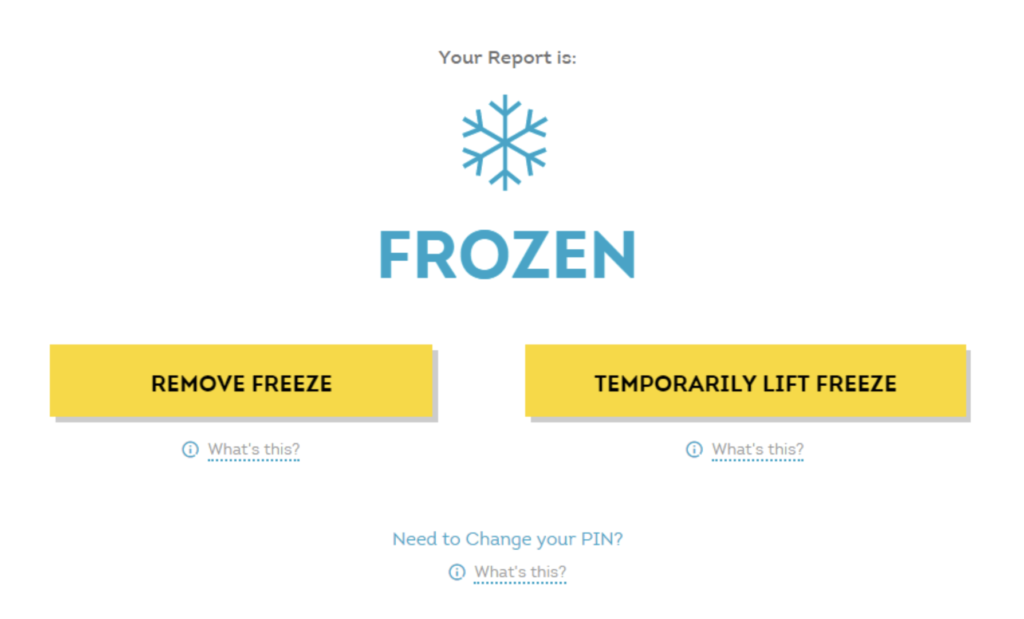

4. Thaw or Lift When Necessary

Should you decide to apply for new credit, you can temporarily lift or thaw the freeze using your PIN. This process can be completed online, by phone, or by mail, depending on your preference.

The Cost of a TransUnion Credit Freeze

Since September 2018, credit freezes at all three major credit bureaus in the United States, including TransUnion, have been made free of charge. The change came as part of the Economic Growth, Regulatory Relief, and Consumer Protection Act, making it more accessible for individuals to protect their credit.

The Effectiveness of a TransUnion Credit Freeze

A TransUnion credit freeze is highly effective at preventing unauthorized access to your credit report. However, it’s essential to understand that it doesn’t impact your existing accounts or your credit score. You can continue using your current credit cards and loans as usual.

Security of Your PIN

Your PIN or password is a critical component of the credit freeze process. Keep it secure and easily accessible when needed. Losing your PIN can complicate the process of lifting or thawing the freeze.

Credit Monitoring and Alerts

While a TransUnion credit freeze is an excellent security measure, it’s wise to consider credit monitoring services as well. These services provide alerts if there are any suspicious activities on your credit report, even with a freeze in place.

Conclusion

In an era where data breaches and identity theft are all too common, a TransUnion credit freeze provides a robust defense against unauthorized access to your credit report. By taking advantage of this powerful tool, you can fortify your financial security, gain peace of mind, and proactively protect your credit and identity from potential threats. Remember that placing freezes with all three major credit bureaus—TransUnion, Equifax, and Experian—provides comprehensive protection against identity theft and fraud. Your financial well-being is worth safeguarding, and a TransUnion credit freeze can be a valuable part of your defense strategy.