In the enigmatic world of finance, one acronym holds the key to countless financial opportunities, dreams realized, and doors opened: FICO. The FICO score, a three-lettered acronym representing the Fair Isaac Corporation, is far more than just a number. It’s a complex algorithm that quantifies an individual’s creditworthiness. In this comprehensive article, we will delve into the depths of the FICO score, deciphering its intricacies, exploring its impact, and understanding how it shapes our financial lives.

Unraveling the FICO Score: What is it?

At its core, a FICO score is a numeric representation, typically ranging from 300 to 850, of an individual’s creditworthiness. It’s a measure of how likely someone is to repay borrowed money on time. Lenders and creditors rely on FICO scores to assess the risk associated with lending money to consumers.

The Anatomy of a FICO Score

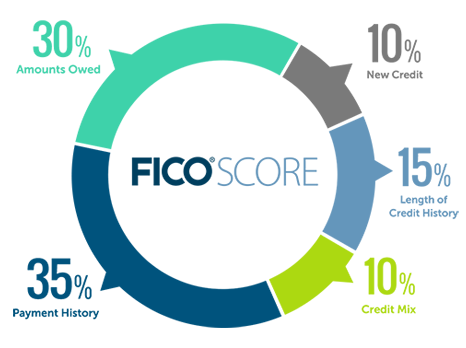

A FICO score isn’t a random number; it’s meticulously calculated based on a range of factors, each carrying a specific weight. Understanding these components helps demystify the FICO score:

- Payment History (35%): The most significant contributor to your FICO score is your payment history. It reflects whether you’ve paid past credit accounts on time and any derogatory marks, such as late payments or collections.

- Credit Utilization (30%): This factor evaluates your credit card balances compared to your credit limits. A lower credit utilization ratio typically indicates responsible credit management.

- Length of Credit History (15%): The length of your credit history matters. Longer histories often result in higher FICO scores.

- Credit Mix (10%): A mix of credit types, including credit cards, installment loans, and mortgages, can positively impact your FICO score, signaling your ability to manage diverse financial obligations.

- New Credit (10%): Opening multiple new credit accounts in a short period can raise red flags. FICO considers how many new accounts you’ve opened and recent credit inquiries.

Why the FICO Score Matters: Its Real-World Impact

The FICO score isn’t a mere numerical abstraction; it has tangible consequences on our financial lives:

- Loan Approvals: Lenders use FICO scores to evaluate loan applications. Higher scores increase your chances of loan approval.

- Interest Rates: A high FICO score can secure lower interest rates, saving you money on loans and credit cards.

- Credit Limits: Lenders often extend higher credit limits to individuals with excellent FICO scores, increasing your financial flexibility.

- Insurance Premiums: Some insurance companies use FICO scores to determine premiums, potentially leading to lower insurance costs for individuals with good scores.

- Rental Applications: Landlords frequently consider FICO scores when evaluating rental applications. A strong score can make you a more desirable tenant.

FICO Variations: Not a One-Size-Fits-All Score

While the classic FICO score is the most recognized, variations exist for different purposes:

- FICO Auto Score: Designed for auto lenders, it focuses on your history of paying auto loans.

- FICO Bankcard Score: Tailored for credit card issuers, it emphasizes your credit card management history.

- FICO Mortgage Score: Primarily used by mortgage lenders, it assesses your creditworthiness for home loans.

- FICO Score 9: The latest version of the FICO score, it provides a more accurate reflection of medical collections and rental history.

The Quest for an Exceptional FICO Score: Strategies for Success

Cultivating an excellent FICO score isn’t an overnight endeavor; it requires discipline and consistent financial habits:

- Timely Payments: Pay your bills on time, every time. Consistent on-time payments significantly bolster your FICO score.

- Credit Utilization: Aim to maintain a low credit utilization ratio. Keeping credit card balances below their limits is wise.

- Mindful Borrowing: Apply for credit only when necessary. Frequent credit applications can signal financial instability.

- Credit Mix: Maintain a balanced portfolio of different credit types.

- Regular Credit Checks: Routinely monitor your credit reports for errors and discrepancies, addressing any issues promptly.

The FICO Score: A Number with a Transformative Impact

The FICO score isn’t just a number; it’s a financial fingerprint, a testament to your creditworthiness. It shapes the financial landscape of your life, influencing loan approvals, interest rates, and financial opportunities. Navigating the intricacies of personal finance means understanding and respecting the power of the FICO score. It’s not merely a statistic; it’s a code, and once you crack it, you hold the key to unlocking countless doors in the world of finance.